"For 99% of human history, longevity was under 18 years." — Ken Dychtwald

"For 99% of human history, longevity was under 18 years." — Ken DychtwaldGerontologist Ken Dychtwald (LinkedIn profile) of Age Wave spoke about aging and retirement at CALU 2011. (In the previous blog post, we discovered how the wealthy feel about their advisors.)

History

"I hope I die before I get old." — My Generation, The WhoImagine 99,000 years with a life expectancy at birth of less than 18 years. Our ancestors died before they got old. Infectious diseases were a big culprit. Maybe the rock bands of those eras sang "I hope I live until I get old".

Now, living a billion seconds is commonplace. Since 1900, US life expectancy has grown from 47 years to 80. That's a huge change in one century and unprecedented. Count on this trend continuing with medical advances. If only there were inventions to make our money grow and maintain our quality of life.

Economic Uncertainty

We risk losing health as we age. Treatment, lifestyle adjustments and long term care can be expensive.The greatest fear is becoming a burden on the family (55%), followed by ending up in a nursing home (24%) and using up savings (12%). For the caregiver, the biggest worry is the emotional toil (57%), followed by the costs (49%) and impact on their own lifestyle (21%). That's from the 2010 Let's Talk survey conducted by Age Wave and Harris Interactive for Genworth Financial (PPT).

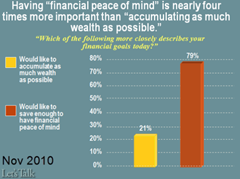

Would you rather have more money or predictability?

According to the same survey,

- 21% want to accumulate as much wealth as possible, while

- 79% want to save enough to have financial peace of mind (whatever that means)

In another CALU session, David Solie (LinkedIn profile) said that aging and volatility have created a new species of complexity. We're getting older and can't count on what we counted on counting on. Will it get any worse?

The Evolution Of Retirement

In this video, Ken shows how retirement has changed over the years.The Science Of Longevity

Not only are we living longer, medical developments are likely to continue that trend.The Bright Side

In the past, life was linear: education, work/family and leisure (retirement). Is that appropriate now that we're living longer? Why not spend our "longevity bonus" throughout life rather than at the end? If you're an employee, this is tougher to do. Entrepreneur have much more flexibility — should they choose to use it.If you like what you're doing, you might continue working. That helps pass the time and provides income. Retirement can now last longer than people lived in prior millennia. Rather than leaving a legacy, there's an opportunity to live a legacy.

Links

- How the wealthy feel about their advisors (CALU 2011)

- Genworth/Age Wave "Let's Talk" Survey (2010) | PDF and PPT

- Long Term Care survey (Genworth Financial press release)

- Dealing with the staggering cost of dementia

- Your life expectancy exceeds 1,000,000,000 seconds

- Afraid So (Jeanne Marie Beaumont, poem read by David Solie)

- photo courtesy of Steve Jurvetson (US) + discussions

Podcast 117 (4:45)

direct download | Internet Archive page | iTunes

PS Let's take care of our health now so pain doesn't prevent us from enjoying our longevity bonus.

Great post Promod. I agree with the ever increasing age limits, and the confusion of when to retire and how much to have in the piggy bank.

ReplyDeleteLove the facts and figures included in the article.

Thanks for your comments, Brahm.

ReplyDeleteI knew that we're living longer but lost sight of how unprecedented the change has been in the historical context.