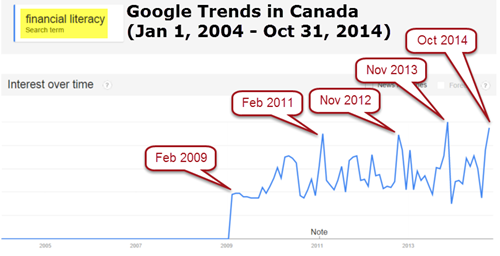

November is Financial Literacy Month in Canada. Getting attention during the busy period between Halloween, Black Friday, Boxing Day and New Years Day isn’t easy. According to Google Trends, interest in financial literacy has been growing. That’s great news. Kudos to everyone helping create awareness.

November is Financial Literacy Month in Canada. Getting attention during the busy period between Halloween, Black Friday, Boxing Day and New Years Day isn’t easy. According to Google Trends, interest in financial literacy has been growing. That’s great news. Kudos to everyone helping create awareness. There’s more to do.

There’s more to do.The Challenge: Current Creators

If you already create ongoing financial education, Thanks! Why not try something new:- change your format: you likely prefer text, audio, video or photos. Try a different one.

- go live: e.g., hold a Hangout On Air, speak at an event or have a Twitter chat

- adjust your frequency: create more content or cut back to make time for something new

- alter the length: you could make your content longer or shorter

- experiment with a different platform: are you using the LinkedIn Publishing Platform or Pinterest?

You might reach a new audience and feel more enthused to create more content.

The Challenge: The Silent Million

According to Statistics Canada, 1,122,300 people worked in finance, insurance, real estate and leasing in 2013. That’s 6.3% of the workforce (1 out of 16 people). How many of them publish their own original content to help the public understand money better? Now’s an ideal time.If a mere 2.7% published a single article during Financial Literacy Month, we’d have 30,000 new articles --- 1,000 a day. And 100,000 articles only requires 8.9% to volunteer for a worthy cause which their employers likely support.

Others know about money too. For instance, accountants, entrepreneurs, executives, lawyers, professors, retirees and teachers. Include them and 1,000 pieces of fresh content a day looks even more feasible.

If each creator promotes to their connections, imagine how many new people could be reached and helped.

Case Study

I’ve been looking for ways to engage people who aren’t especially interested in learning more about money.For last year’s Financial Literacy Month, I organized Money 50/50: Insider Advice For Today’s Topsy-Turvy Times at the University of Toronto (like TEDx plus Q&A). November got postponed to February and the Ted Rogers School of Management (see recap). Since TEDx Talks become videos, I decided to skip a live event and interview these insiders who might have been speakers:

- How much money do you need before getting financial advice? (Joe Barbieri)

- Financial independence at 31 (Sean Cooper)

- The Capital Gains Exemption isn’t a gimme (Mark Goodfield)

- Insights from an advisor to the insurance industry (Ross Morton)

- Reaching the unreachable (Jonathan Chevreau)

- Investing outside the markets (Vikram Rajgopalan)

- Five essentials to being a better investor (David Toyne)

- Planning for aging (Gary Hepworth)

- Demystifying SR&ED (Julie Bond)

- Retirement planning for small business owners and professionals (Clark Steffy)

- guiding Grade 8 students through the Economics For Success via Junior Achievement

- sharing Business Strategies For Taxing Times at the Toronto Regional Board of Trade

- launching a series of short educational videos called QanA (Question an Actuary)

Links

- Three reasons financial literacy eludes us

- The A-B-Cs of 1-2-3: the key to financial literacy / numeracy

- Do your advisors help with your financial literacy?

- How to screen your sources for financial literacy education (#FLM2013)

- Forget your financial literacy: check your pizza literacy

- Why don’t financial educators have a larger audience?

- Jim Flaherty on the economy and financial literacy (2009)

No comments:

Post a Comment