The Content Disappeared

I clicked and found the page was empty. The link isn’t broken but the content is gone.

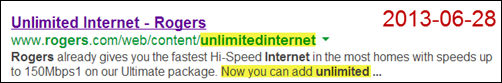

Google To The Rescue

Now I was curious. Luckily, Google saved a copy of the page eight days earlier. The unlimited option is “Now Available until June 30th”. Does this mean the bandwidth caps return on July 1st? Probably not. The offer probably means you must get the option before the deadline but can keep it “forever”.

The offer looks real and with no sneaky fine print. The price isn’t too crazy either (an extra $30 per month). I thought there might be daily limits, restrictions during busy periods or bandwidth throttling. There’s no mention but maybe those things happen. Years ago, my Bell mobile plan had “unlimited” data [don’t ask the price] but I was told that meant 5 GB.

Your Call Is Important To Us

I phoned Rogers to get the unlimited data. Since my call is important to them, I got put on hold for minutes. Finally, I spoke to a rep. He confirmed the $30 offer was available and that unlimited meant unlimited. Why wasn’t I told about the option? He said the plan was unadvertised: you must phone in to ask. How is that fair?The Shock

In passing, I asked for confirmation that we’re really on the 150 Mbps plan. He checked and said … no. We’re on a 75 Mbps plan. This came as a shock but explains things.Some months ago, I asked about upgrading from 75 Mbps to 150 Mbps. I was told the new Ultimate plan cost $123 per month but we were grandfathered at our current rate of $103 per month. We just needed to upgrade our modem to get the higher speeds. This cost an extra $1 per month (an increase from $7 to $8). That seemed fair but why hadn’t Rogers told us proactively?

Less Than Expected

From our bill, we thought we had been upgraded because we were paying for the better modem. However, our Internet service deteriorated.

We weren’t getting double the old speed. Even worse, we had intermittent problems. We’d lose our Internet connection or get painfully slow speeds at times (even when using our our wireless router). I called for technical support several times. They couldn’t find a problem. I was never told that we weren’t getting 150 Mbps because we on the same 75 Mbps plan.

Facts

Thanks to SamKnows, we can now see our actual Internet speeds. We’re shown as being on the 75 Mbps plan but we’re getting a faster speed consistently (perhaps due to the modem or improved service from Rogers). That’s terrific … except we thought we were on the 150 Mbps plan.

How could we tell we were getting fooled?

The Misleading Account information

Our account was inaccessible after the switch to unlimited data. Perhaps that’s because the changes were being made. When I got through, I couldn’t find any indication that we were on an 75 Mbps plan.

How could you possibly tell that you’re on the less-than-Ultimate plan? The plan options do not show the 75 Mbps plan.

While we’re here, notice the jump in price from

While we’re here, notice the jump in price from - 45 Mbps (Extreme Plus): $75

- 150 Mbps (Ultimate): $123

Suggestions

What are you really getting from your Internet provider? Don’t trust what you’re told verbally. Find out what speed your plan actually offers. Ask about an unlimited option since that’s very useful if you backup data online or watch Netflix in HD. You also get peace of mind.We’ve been fooled by Rogers in at least three ways:

- We thought we had been upgraded to a faster Internet plan.

- We had performance problems for months after the “upgrade”.

- We didn’t know we could get unlimited data.

Links

- A review of Rogers Unlimited Internet (new)

- The horror of Rogers ‘Ultimate’ Internet

- Great customer service from Rogers

- The right way to view Netflix in Canada

- Fight Back against corporate trickery with Ellen Roseman’s insider tips

- Buyer beware: the best way to measure intent

- Reasons to be cynical

- What’s your financial Plan B?

- The power of redundancy

Podcast 226

direct download | Internet Archive page | iTunes

PS Would you rather have faster Internet access or unlimited data?