Looking at shiny new vehicles is fun. You’ll find lots at an autoshow or by visiting different dealerships. The problem comes when buying. Emotions and wallets get involved. Spend a little more, a little more, a little more, …

Looking at shiny new vehicles is fun. You’ll find lots at an autoshow or by visiting different dealerships. The problem comes when buying. Emotions and wallets get involved. Spend a little more, a little more, a little more, …We’ve been looking for a replacement for our three year old leased Mercedes-Benz ML 350 Bluetec diesel. A comparably-equipped current model costs $7,000 more …

Key Factors

When deciding on a vehicle, look at- the cost of maintenance: This is “free” with BMW. Audi and Mercedes let you prepay. Lexus uses the old pay-as-you-go model.

- the options: While 20” rims look nice on an SUV, the tires don’t last long (heavy vehicle, not much rubber). I replaced a set at 40,000 km for $2,200. That was an unpleasant surprise.

- the lease rate: varies by term. Often lowest for 36-48 months. There may be unadvertised discounts. For instance, Mercedes offered a reduction of 1.5% (0.75% loyalty bonus + 0.75% as an autoshow special)

- your initial outlay: how much money do you pay when you take delivery? The dollars can add up quickly. When comparing vehicles, make sure this matches.

- the residual value: when leasing, you’re financing the difference between the purchase price and the estimated depreciated value at the end of your lease. A high residual (55% on our current Mercedes after 36 months) reduces your costs. A cheaper vehicle with high depreciation could cost you more than a pricier vehicle with lower depreciation.

Skip The Autoshow

We went to the Canadian Autoshow for the first time, thanks to free tickets from Mercedes. We chose the first Sunday and arrived shortly after opening. What a zoo! There are lots of vehicles but you can’t do much more than wait your turn to sit in them. I thought we’d see lots of autoshow specials but they aren’t advertised here.Rather than paying for tickets, parking and food, visit dealerships for test drives. The showrooms tend to be close together, which saves you time. We tend to go on weekday evenings after dinner and past the ‘rush hour’ traffic. Avoid Saturday (though that might be a good time to negotiate).

Do Your Research

You’ll find lots of information online. You might start your search here. The best site for comparisons is US News & World Report. They amalgamate reviews from other sources such as Edmunds and Kelley Blue Book. They also rank vehicles by category. That’s a nice time saver.

You’ll find lots of information online. You might start your search here. The best site for comparisons is US News & World Report. They amalgamate reviews from other sources such as Edmunds and Kelley Blue Book. They also rank vehicles by category. That’s a nice time saver. Because it has the best combination of positive reviews, price and long-term ownership costs in its class, we named the 2014 Lexus RX 350 the Best Luxury 2-Row Midsize SUV for the Money.

— US News & World Report

The Cost of Ownership

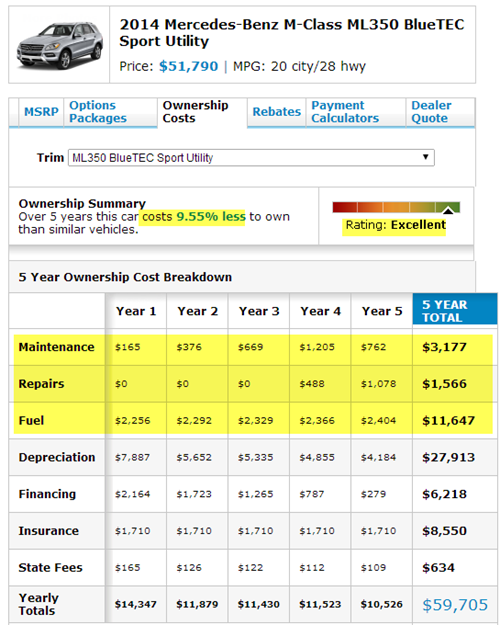

What are the costs of maintenance, repairs and fuel? Motor Trend does a cost breakdown over the first five years and includes other categories — another time saver. Your actual results will vary. The example below shows a Mercedes diesel SUV is rated excellent compared to similar vehicles. The costs are still high, especially in years 4-5. If you’re leasing for three years, that won’t matter. If you’re buying or considering buying after your lease ends, you will.

The above information is for the US but is good for relative comparisons.

The Value of Your Current Vehicle

If you’re trading in your current vehicle, how do you know what it’s worth? Get a free estimate with Canadian Black Book. Rather than trading, you might get better results by selling the old vehicle yourself.When negotiating, you’re at a disadvantage when you disclose too much. It’s wise to get the best price for your new vehicle before saying you want to get rid of your old one.

Buy or Lease?

Unless you must have the latest model, buying looks like an ideal choice. That might not be the case unless you have an affordable mechanic you trust. Even then, you’re still at risk. Cars are packed with technology that must endure extreme conditions such a temperatures that range from freezing to boiling. That makes the repair costs are difficult to predict. The blind spot sensor in my three year old Mercedes failed. The replacement was $1,800, excluding labour, tax and inconvenience. The warranty covered the costs but a surprise like that could happen later too (unless you don’t have this useful feature).Our solution is to lease our primary vehicle for 36-48 months while the manufacturer’s warranty applies. That provides peace of mind. We also have a Toyota minivan we bought years ago. Selecting a vehicle with low service costs also helps.

If you drive more than 24,000 km/year, leasing may not be feasible. If you buy, do consider an extended warranty. They’re cheapest at the time of purchase. You get peace of mind and increase the resale value.

Get Discounts

You’ll save money if you’re flexible.You get the best deals when you buy what isn’t selling well. You’ll get an idea from the lease rates. For instance, BMW leases the 535i xDrive Grand Turismo at 3.9%. Last year’s model drops to 0.9% for terms up to 48 months and benefits from generous discounts that get better as inventory drops. Hyundai is leasing last year’s Genesis sedan at 0% but paying cash saves you $11,000.

You save more when you get a low mileage demonstrator. These models tend to have more features and bigger discounts. They’ve been well maintained. Plus, you don’t pay for Freight and PDI costs get waived, which can save you $2,000.

Negotiating

What’s a fair price to pay?Get a free price quote from Unhaggle. In exchange, you provide your name, email and phone number. This goes to a dealership. I tried their service for three vehicles. Two dealerships called within 30 minutes. That’s okay since you now have someone to answer your questions on the phone. Unhaggle will also negotiate for you for $99 without identifying you. If you get a better deal, they'll refund their charge. Maybe they’re worth a try?

Links

- Is your car built to last?

- The car mechanic: paying for effort or results?

- What to do when your car lease ends

- Small cars: is ‘safer than ever’ safe enough for you?

- The most dangerous part of driving

- Marketing lessons from the Hyundai Genesis

- The best buying experience: Audi vs BMW vs Mercedes-Benz

- Three lessons from the salespeople at Audi, BMW, Lexus and Mercedes

- The car purchase: recovering from bad service

- image courtesy of Alvimann