When you get a mobile phone in Canada, you typically get a subsidized phone and a 36 month contract with nasty penalties for early cancellation. The rules changed (Toronto Star) in June. Now Canadians get the world standard of 24 months. The new plans generally offer unlimited nationwide calling. That I’d like since Bell only give me 250 local weekday minutes.

When you get a mobile phone in Canada, you typically get a subsidized phone and a 36 month contract with nasty penalties for early cancellation. The rules changed (Toronto Star) in June. Now Canadians get the world standard of 24 months. The new plans generally offer unlimited nationwide calling. That I’d like since Bell only give me 250 local weekday minutes.Don’t count on saving money, though.

Rogers, Bell and Telus (sometimes called Robellus) control about 90% of the market. The cheaper options — Mobilicity, Public Mobile and Wind Mobile — are all for sale (CBC). They don't offer the same coverage zones or high speed LTE. Those omissions may matter depending on where and how you use your phone.

On The Horizon

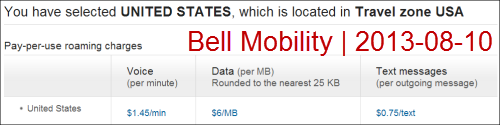

There’s speculation that Verizon may enter Canada to buy Wind, Mobilicity and 700 MHz spectrum. Robellus thinks that’s bad but Canadians and the government disagree.Since Verizon is a premium carrier, rates may not drop. However, there would be more choice and perhaps more competition. Maybe roaming rates would improve. Right now, Bell charges me $1.45/minute ($14.50 for 10 minutes) and $6/MB ($600 for 100 MB) in the US.

In contrast, Verizon offers US customers visiting Canada 1,000 minutes for $15 and 100 MB for $25. Pay-as-you-go costs $0.89/minute and $2.05/MB — still much cheaper.

Life Insurance

Canada used to have major foreign insurers such as Met Life (where I worked) and ING (NN Financial). Both left to pursue higher returns elsewhere. While here, they operated much life the domestic companies.What's going on? Thank Canadian laws, regulation and competition. Since shareholders demand high returns, why would Verizon cut rates drastically in Canada?

Contracts

When you have a mobile phone contract, you can't easily take advantage of new offers. You're stuck until the end of your term because of penalties. Wind is considered consumer-friendly and the Windtab is a way to get a monthly subsidy to offset the price of your phone. The length got reduced to 24 months, unless you entered the arrangement when the period was 36 months. Don’t expect other carriers to offer you better terms either.Life insurance is similar. As plans change, you're stuck. You rarely get the upgrades unless you buy a new plan. Plus, this process requires underwriting that could require body fluids. Since you're older, you'll likely pay higher premiums even if the rates have decreased. You'll want to think carefully before making changes.

Victors

When offered a choice, Canadians often prefer US companies: Walmart over Zellers (which Target bought), Home Depot or Lowes over Rona, Apple over Blackberry. There are always winners and losers. Let consumers win.But Insurance

Life insurance is quite different. There haven't been major new entrants in ages. Also, you tend to buy through an advisor rather than directly.If you don't like mobile phone contracts, you won't like life insurance contracts any better. You won't find sites that do thorough comparisons for complex products like universal life and whole life. There are basic comparisons for term life but the focus is on price, which is a simplistic measure. As with mobile plans too.

There are also similarities between the contracts for mobile phones and life insurance. Try reading them and see if you understand them.

Links

- Anti-Fair for Canada sites arrive to fight Robellus (Mobile Syrup, Aug 9, 2013)

- Getting signals straight in the Great Wireless War of 2013 (Michael Geist, Aug 6, 2013)

- Lease or buy? How life insurance compares with getting a car

- Rona: why investors should stay away (The Motley Fool, Jul 2013)

- Tips for first-tie life insurance buyers

- The best and worst times to cancel your life insurance

- Reinstatement: trying to get your insurance back

- The perfect smartphone: bye bye Blackberry

- Test your life insurance literacy

- What’s your financial Plan B?

- image courtesy of Studio CI Art

Podcast 232

direct download | Internet Archive page | iTunes

PS What do you think of Verizon?

No comments:

Post a Comment